How to become a Commercial Finance Broker

This article is aimed at people involved and working in Financial Services, either employed or self-employed.

As the UK starts to emerge from the restrictions, then many of us have had time to reflect on our current home working lifestyle and will also start to go back to employment within the office.

Also many Self Employed Mortgage Advisers will be looking for opportunities to expand their service offer and create another income stream to diversify income for future years; with that in mind, we have written an article outlining how to become a commercial finance broker.

I started my journey in Commercial Finance broking in 2003 when I decided to leave my Director role in a bank to go self-employed. I had always had the urge to work for myself, advising clients on how best to navigate the commercial finance world and assist them to grow their businesses.

Since that point we created an ethical approach to advising and retaining clients for the long term. I still have some clients since our inception and this tradition continues with the other directors that now work in the wider team.

“It’s been an interesting ride so far”.

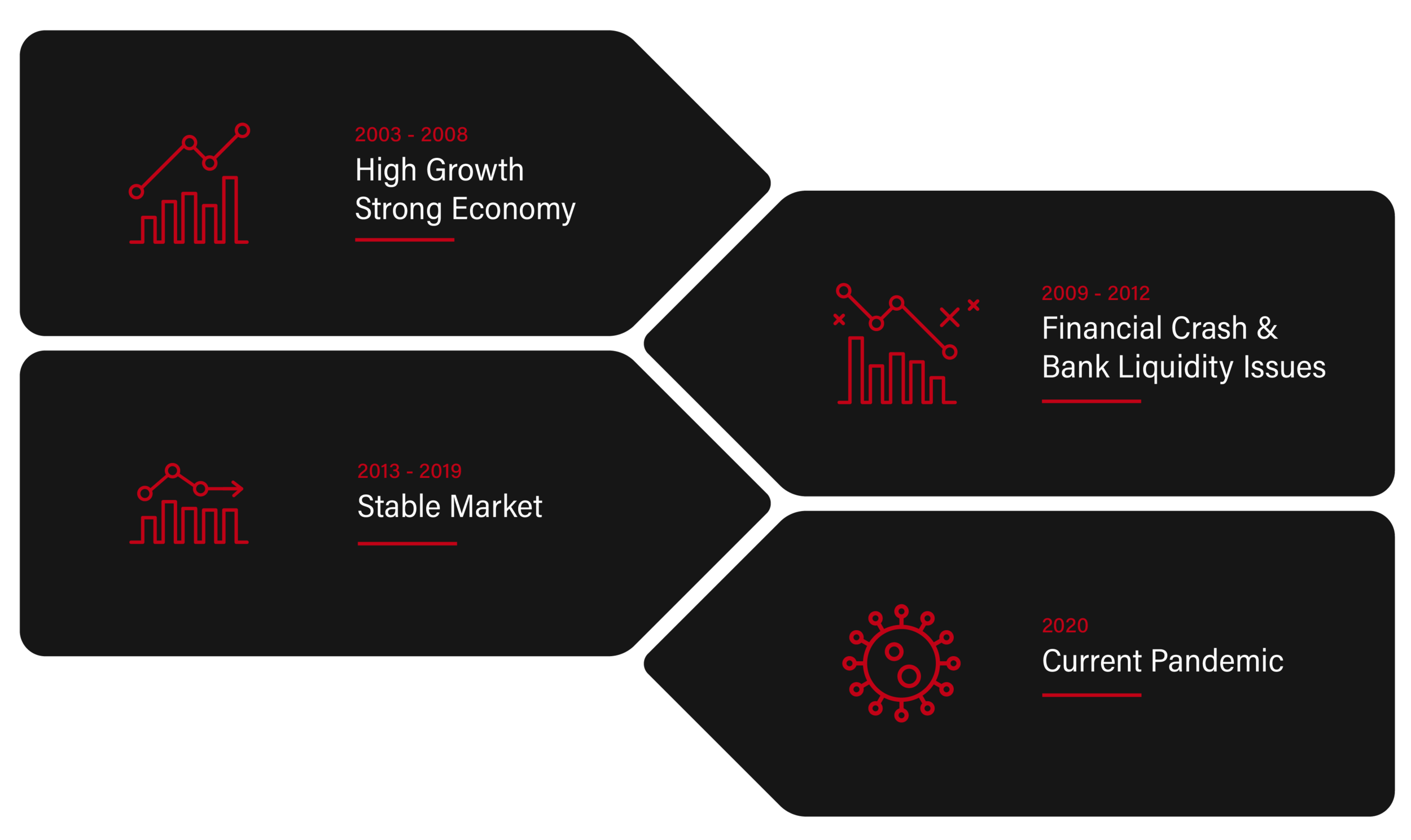

We have worked through both Economic good and bad times and are still here. We have been able to adapt the advisory process and lending model to cope and improve our strength in depth. Mentoring and assisting our other advisers.

Highlights/Lowlights

Here are some previous questions that our other advisers have posed before joining our team; this will hopefully give you an idea s to how to become a commercial finance broker.

Frequently Asked Questions

What is a Commerical Finance Broker?...

A You would be directly advising clients on how to structure and raise money to assist cash flow, finance the purchase of equipment, commercial mortgages and BTL and development finance.

What qualifications are required?...

A Nothing formal is required but Cemap and or Commercial Banking Finance qualifications would be a bonus.

What skills are required?...

A Being well organised, good with people, persistence, but mainly a positive attitude to learning in the role. Mentorship is all part of our culture.

How will I learn to work with clients?...

A Full support for fact finding and processing can be offered where needed, with the ability to get support for meetings and loan structures from senior directors. We will help you build your confidence and skillsets over time.

Where will my business come from?...

A You will get your business from a mixture of your own business development with other professionals and referrals from the main business. A full business development plan will be created on day one, with regular monthly reviews and meeting to spread best practice and strategies that work.

What can I earn?...

A Much depends on if you are part time of full time, FTE in year 1 should be looking for £60k, Year 2 £80k and Year 3 above £100k. It’s about building that relationship with clients that keeps them coming back.

What support will I get?...

A Senior Director Mentorship, Business planning support, business development support, ongoing weekly deal structuring forum, deal progression support and monthly team meetings, along with social events.

What hours will I need to work?...

A That depends on what you can give, the work is flexible and fits around your lifestyle. We have people working full time standard hours and some who work part time around other family lifestyle commitments. It’s all about what works for you and your clients.

Can I work and train with you and still keep another consultancy working?...

A Yes, we are fine with you working part time with us and having another consultancy, as long as there are no conflicts. If you are involved in Financial Services in the roles and circumstances below, then please get in touch for more information.

Now, if the answer is YES to any of the following, then we are looking for suitable candidates to join our 2022 Mentorship Programme.

Your Current or Existing Role

Para-planners

Mortgage advisers (employed or self-employed)

Commercial Finance Managers with a Lender

Financial Services Sales

Underwriter/Lending

Present Circumstances

Re-location with your partner’s new job

Returning from Maternity leave

Early Retirement/Redundancy

Want a lifestyle change from Corporate fixed hours to flexible home working around family

Wanting to enhance your Commercial Advising skills

If the answer is YES to any of the above, then we are looking for suitable candidates to join our 2020-21 Mentorship Programme.

We have self-employed roles in the following:

Associate

Commercial Finance Manager

Director

*Entry level depends on experience, with full and part time roles to compliment your existing business and time available.

Our programme branded in the I-Commercial Finance team, will:

1 Day “Business plan Builder” with budgets for you.

1 Day “Business Network” planning session.

Ongoing monthly Mentorship with weekly strategy call.

Access to our lender panel.

All IT, emails and Compliance/CPD support.

Group membership to NACFB and our PI Policy.

Ongoing Lending and underwriting training in property finance and trading business finance.

Deal progression Support.

Access to our wider introducer network.

Social Media coverage and addition to our website.

Share goals and our team approach.

Enhance your skills and opportunities whilst working in a highly ethical environment.

With over 100 years of collective experience, we are client focused and achieve great outcomes for our clients.

Contact us at info@i-commercialfinance.co.uk or click on the button below for more information:

About the Author