Comparing the 2009 Crash with 2020; are we seeing the same impact on Development Finance?

How to fund Property Development after Lockdown?

Strategy & Risk Planning the Development

This has always what I have done for 20 years with every development project that a client has put to me. I spend many hours looking at the way in which we can reduce “RISK” for the developer and funder and reduce any equity required to execute the project.

The more we can reduce equity in each project, then the more liquidity there will be in the company to cover overheads in uncertain times.

Key areas we cover:

Land price and proposed purchase structure.

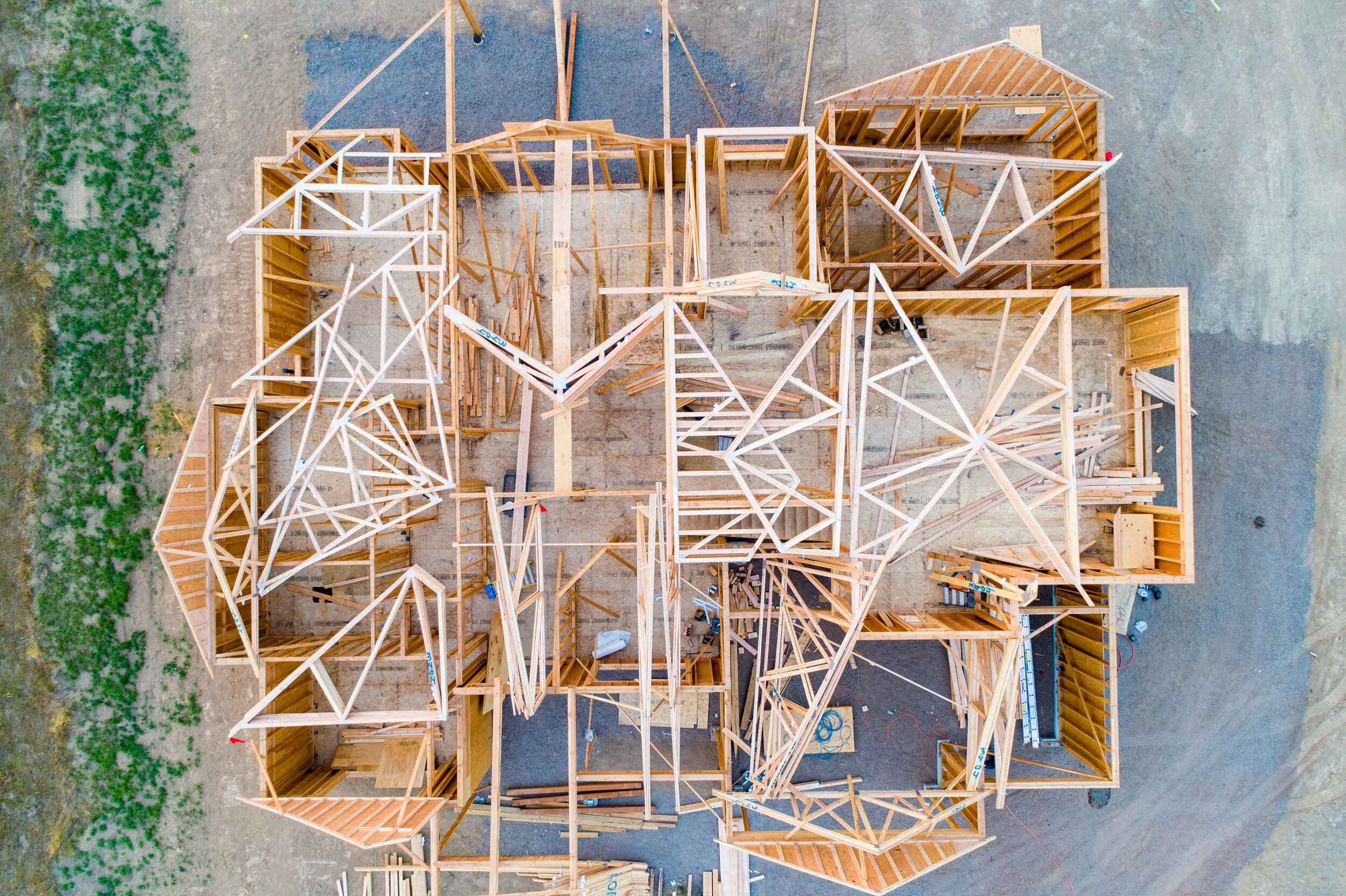

Construction programme and any phasing approach.

Location and sales numbers, with sensitivity on numbers.

Exit strategy if sales are slow? A Plan B & C?

I operate a cash flow based development appraisal which can work out all aspects of how the project will work from start to finish.

We will then work on land purchase numbers and any deferred periods that may help, along with phased construction programmes and contractors with sub-contractors.

We take time to work out a number of options that can be looked at. Each option would have our thoughts on risk of execution and effects on profit margin.

Options are created by our knowledge of development funding markets and fully understanding what a lender will accept and support for each type of project.

That will vary from each lender and the geography of the site.

Find your Funding Partners

All the strategy work, was to assist in understanding the project and how a deal could be successfully done with the land owner.

My recommendation is that a set of funding partners are put in place “In principal” so that we know the project can be financed.

As the market is in turmoil, then most senior debt funders have restricted their LTV % on GDV. Not unusual in nervous times. You have 2 options:

Put more money into the project to make it happen.

The alternative is to put “Mezzanine” funding into the scheme to fill that reduction in LTV from senior debt lenders.

Mezzanine Finance is a perfectly acceptable solution and indeed we model this type of finance into the GP of the project and show you the effect on equity needed and Return on Equity deployed in the project.

Mezzanine is a great tool and will allow projects to proceed and give the developer the benefit of higher liquidity.

Note of caution: Make sure your adviser has done senior debt/mezzanine development finance before. There are many people on website that say they do it, but have not.

It’s important that your chosen adviser has a panel of lenders that have mirrored legal and due diligence between senior debt and mezzanine provider. Otherwise it will just not work.

In simple terms have they successfully concluded projects before?

Also check the adviser has recently done a senior debt /mezzanine project as experience to navigate the process and pull everything together is key?

Agree Land Deal

Once you have logical finance offers, then proceed to your final land deal discussions with vendor.

Prior to the market crash in 2009, land prices were high and vendors expected payment in full on Day 1.

This fundamentally changed after 2009, with more acceptance of stage- payment land purchases and or deferred considerations or Joint Ventures.

More recently I have seen land prices revert closer to the pre 2009 model. However once again we will be moving back towards stage payments to make projects lower risk.

This is why I spend so much time with clients on strategy, risk & funding.

It helps create evidence base and logic to a vendor on how a land purchase can happen.